Your Legacy

Are you considering some or all of your estate to charity? Leaving money to charity is a laudable goal, and if you do this you can:

- Sustain the charities that matter most to you, touching people’s lives in a deeply meaningful way. Charities and non-profit organizations often rely on private funding to continue doing their good work, and leaving them a gift in your will can impact people’s lives for years after your death;

- Create a personal legacy. A significant donation to an organization that holds meaning for your will allow your memory to live on in those who turn those funds into good works; and

- Provide financial benefits. Depending on the way you gift the funds, you, your estate, or both might enjoy certain tax advantages.

Your gift to charity can be done in four formats through your will:

- A general gift is a specific amount of money or percentage of your estate;

- A residuary gift is any remaining assets after all other requests have been fulfilled (to ensure that your estate rewards other beneficiaries first);

- A specific gift, such as the donation of a particular item (e.g. art, jewelry, vehicle, real estate); or

- A contingent gift that is based on certain conditions being met, such as your main beneficiary passing away before you.

These are all great, but there are some alternatives to leaving the donation in your will. If you are going to be leaving a significant amount money to charity, it’s a good idea to look at the options to see which one provides the best value to yourself and the charity, you can make a bigger impact with the same funds.

Before we get too far into this article, let me be absolutely clear: I am not a professional financial planner. The purpose of this article is to make you aware of some options to leaving money to charities in your will. If any of these ideas appeal to you, please discuss them with a professional financial planner, as they are much better equipped to help structure the best solution for your personal situation. The laws in your country or province may provide a different set of advantages and disadvantages than those shown here.

Family Harmony

Let’s start with your family. Depending on the size of your estate and/or the personalities in your family, there is a chance that your will might be contested by a family member. Maybe they are worried you were unduly influenced in a weak moment, or maybe they just want a bigger share of the pie, but either way, if the will is challenged if can tie up the funds you meant to go to charity for quite some time (or might not make it there at all). A word or a clause out of place can lead to thwarted wishes, costly litigation, family feuds and, often, significant financial loss for the estate and would-be beneficiaries.

To avoid this you should discuss your legacy wishes with family members, helping them understand your intent and reasoning. Consider naming an alternate beneficiary for your legacy gift in case your foundation no longer exists when you pass away, and let your charity know that you’ve thought of them in your estate plans.

In addition, you might want to consider some of the options below that ensure that the charitable givings are excluded from your estate, ensuring that they end up supporting the causes that mean the most to you.

It’s a Credit, Not a Deduction

Donations to registered charities are often called “tax deductible”, but what you need to remember is that they are a non-refundable tax credit, not a deduction. Why is this important? You can get a credit for all donations to registered charities, up to 75% of your net income. In the year of death (and going back one year), the limit is 100% of net income. This means that there is a limit to how much of the credit your donation qualifies for will be realized. Many people show lower income in their last years, and if you left a significant amount to charity, your estate will forego some of those tax credits, in a real missed opportunity for either your family or the charity you selected.

You and the Charity Could Benefit Today

Most of us wish we could reduce the amount of taxes we pay right now. I assure you: every charity wishes they could increase their donations today.

If you are in a place in your life where your financial situation is comfortable, stable, and you are on track to meet your retirement savings goals, consider making more of your donations now, rather than waiting for your death. If your savings go into your estate, they can be subject to probate fees which will reduce the amount that goes to the charity. Instead consider making annual donations for as much of your disposable income as you are comfortable with now. You will see the tax credit that comes with the donation now, reducing the income taxes you pay, and your favourite charity will receive annual support.

If your circumstances change, you can increase or decrease your rate of donation each year. You are not locked in, and you can structure your donations to receive the full charitable tax credit for which you qualify (unless you give a very large amount). The charity will benefit today instead of having to wait for many years, and you will have the satisfaction of seeing the impact of your giving in his lifetime. If you combine this option with a life insurance policy, you can achieve a nice mix of long- and short-term benefits for both you and the charity.

Life Insurance

Life insurance policies are an interesting alternative to leaving a gift in a will. You can choose a policy that will yield the desired death benefit, keeping the remainder of your estate whole for family beneficiaries. A life insurance premium offers four significant benefits:

- The annual insurance premiums can be considered charitable giving if structured properly, giving you a tax credit each year you maintain the premium;

- When you die, the insurance policy will bypass your estate, and is paid out promptly to the charity without any chance of it getting entangled in any debates over the proceeds of your estate;

- Since the insurance proceeds aren’t part of your estate, they avoid probate fees, which can add up on a major gift (1.5% in Ontario); and

- There is a chance the rate of return on the insurance would be higher than other options. Depending on your health and other factors, the insurance premiums could cost less to purchase than the actual death benefit, making it more cost effective than a straight cash donation from the estate.

Give Stocks

Donating stocks to a charity can be advantageous. You will be donating “pre-tax” dollars, and the accumulated capital gains will benefit the charity instead of being taxed. Here’s how it looks:

- You want to donate $1,000, so you sell stock worth that much. If you originally paid $500 for it, you have a capital gain of $500, which is subject to tax. You pay tax and the charity receives less than $1,000; or

- You donate the stock to the charity directly. It receives the shares, worth $1,000, and issues a donation receipt for $1,000. It can then turn around and sell the stock. The charity gets more, and you get a higher donation receipt and are exempt from paying tax on the capital gain that would otherwise result from selling the shares.

Donate RRSPs and RRIFs

Similar to giving stocks, you can designate a charity as a full or partial beneficiary of your registered retirement savings plan (RRSP) or registered retirement income fund (RRIF). Your estate can be subject to a hefty tax hit on the remaining balance of an RRSP or RRIF, as the Canada Revenue Agency treats this as income in the year of death. Depending on your estate’s income in the last year, this money can be taxed at at 50% (or more), plus probate fees. Donating the RRSP or RRIF can avoid this tax.

Set Up A Foundation

If you are in a position to donate a larger amount now, before your death, you might be able to establish a foundation. A foundation manages the donations to earn income by investing the capital. Donations to the foundation are eligible for tax credits. Each year, it disburses some of the funds to the cause or causes you chose, even after you’re gone. Having your donations invested can make them go further, particularly as any growth is within a tax-free environment in the program.

More importantly, it forms a lasting legacy. It can also allow your name or your family’s name to be associated in the long term with your value and the causes that mean the most to you. You can extend your own charitable giving to include family members, friends, and even outside donation sources. Over time, you can select the people to run the foundation when you are gone, keeping your philanthropy alive, passing on your values to the next generation.

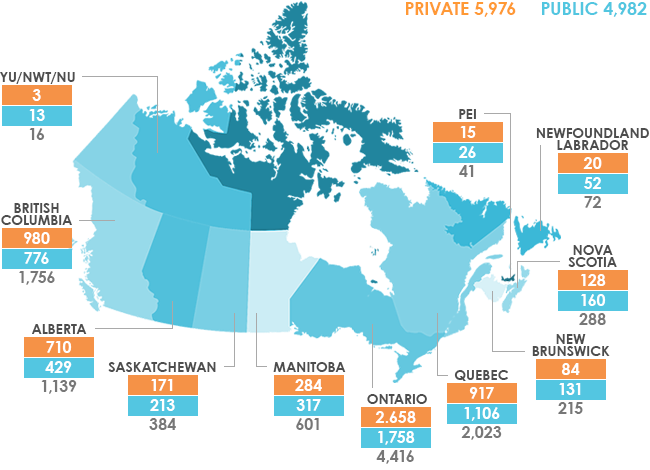

A foundation can be either public or private. They are both charities. The difference is that a private foundation is controlled by a single donor or family through a board that is made up of a majority (more than 50%) of directors at non-arm’s length. A public foundation is governed by a board that is made up of a majority of directors at arm’s length.

Some financial institutions have donor-advised charitable giving programs that can facilitates your philanthropy while reducing your administrative responsibilities, time commitment, and the expensive setup and continuing costs of a running a private foundation. This option is designed to help you maximize your giving while minimizing complexity. This combination of features is why we chose to create The Pale Blue Dot Foundation.

Ontario has the largest number of foundations and 44% of all private foundations.

Source: Canada Revenue Agency (charities listings online as at November 2019).

Set Up A Trust

Donations can also be made through a trust that is established during your lifetime (inter vivos) or upon your death (testamentary). Designated trustees then distribute capital or income up to the maximum federal or provincial tax credits available, the advantage being they can control the timing of the donations and whether they are lump sums or part of an income stream.

A trust in Canada is created when a person (the settlor) transfers property to another person (the trustee) to hold the property and manage it on behalf of other persons (the beneficiaries), pursuant to terms established by the settlor in the trust instrument. There are many different sub-types of trusts, each with their own specific rules. The benefits of using a trust can change with the times, adjusting the tax credits available for charitable giving in a trust. You’ll need advice from a lawyer, as well as a financial planner.

You Worked Hard For The Money…

Leaving money to charity is commendable, but there are a variety of options that maximize the benefits received by you, your family, and the charity you support. You have worked hard to build your savings. Take the time to explore the options for creating your philanthropic legacy with a professional financial planner. They can help you mix and match these options and more into the correct package to meet your needs now and in the future.

If you don’t already have a Certified Financial Planner (CFP®), you can search for one on FP Canada. They can help you sort through the best options for you, given your own unique circumstances and the laws applicable to your area.